One of the biggest traps of investing is the refrain "do your own due diligence" (DYODD). Frankly at its worst this can be a hollow and dangerous encouragement for inexperienced investors to take a cursory peak at the company's own propaganda -- news releases and investor presentations -- before plopping down good money on a bad speculation. Even worse is the false assurance that people can get by hearing it directly from the horse's mouth (talking to company management or its investor relations department).

Actual, real due diligence starts by reading the company's financial statements and other regulatory disclosures (insider trading reports, technical reports, etc.). This can be hard and time-consuming. It requires you to know how to interpret financial and technical information. Sometimes though real due diligence is easy enough that just about anybody can do it, if they simply knew how.

Since I'm a provocateur but also because I want to see markets be better informed and become more efficient, I've decided to start sharing some of the methods to conduct real due diligence in the mining industry. We'll start by discussing the public availability of permit information (mainly in the United States, sometimes in Canada and elsewhere as well).

The example I will use as a starting point is the U.S. Forest Service permit process. There are plenty of others we can discuss later, some of which I am currently using to help manage mining stock portfolio.

The website at https://www.fs.fed.us/ has some very useful information if you spend enough time to research it. I'm not going to simply just give you all the answers, however, as that won't help you learn how to search and find things like this on your own. Instead, I'll give the motivation by pointing out an actual situation where knowing permit status would be very useful to decide when to buy (or sell) a particular company.

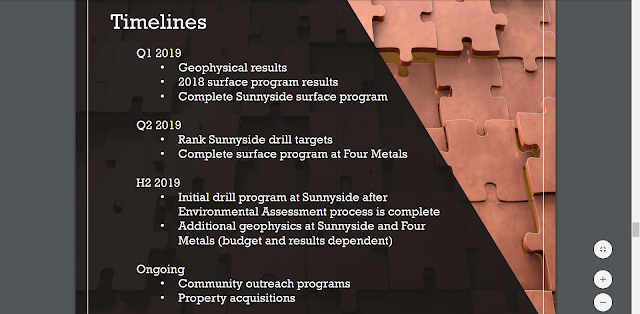

The following 2 images will give you more than enough clues to complete this homework assignment. First, find the name of the company and second find exactly where on the U.S. Forest Service website you can find the file that reveals just how spectacularly wrong this company's management is about the permit timeline for its upcoming drill campaign. Please use the comment section for questions, solutions and discussion. There are a few nuances to this we should go over once you've finished the homework (including what "scoping" means, the public comment process, etc.) and we can do that in the comments section as well.

Actual, real due diligence starts by reading the company's financial statements and other regulatory disclosures (insider trading reports, technical reports, etc.). This can be hard and time-consuming. It requires you to know how to interpret financial and technical information. Sometimes though real due diligence is easy enough that just about anybody can do it, if they simply knew how.

Since I'm a provocateur but also because I want to see markets be better informed and become more efficient, I've decided to start sharing some of the methods to conduct real due diligence in the mining industry. We'll start by discussing the public availability of permit information (mainly in the United States, sometimes in Canada and elsewhere as well).

The example I will use as a starting point is the U.S. Forest Service permit process. There are plenty of others we can discuss later, some of which I am currently using to help manage mining stock portfolio.

The website at https://www.fs.fed.us/ has some very useful information if you spend enough time to research it. I'm not going to simply just give you all the answers, however, as that won't help you learn how to search and find things like this on your own. Instead, I'll give the motivation by pointing out an actual situation where knowing permit status would be very useful to decide when to buy (or sell) a particular company.

The following 2 images will give you more than enough clues to complete this homework assignment. First, find the name of the company and second find exactly where on the U.S. Forest Service website you can find the file that reveals just how spectacularly wrong this company's management is about the permit timeline for its upcoming drill campaign. Please use the comment section for questions, solutions and discussion. There are a few nuances to this we should go over once you've finished the homework (including what "scoping" means, the public comment process, etc.) and we can do that in the comments section as well.

(from Corporate Presentation)

(from U.S. Forest Service)

Based on the history of opposition to the neighboring Taylor mine (and it's subsequent sale), I don't know how Barksdale Capital (bro.v) thinks it will just breeze thru with no opposition from a strong local environmentalist opposition. The fact that Arizona Mining sold itself to South 32 Limited (deeper pockets) shows this. I'm slow (it's also late at night here) so I could not find where to navigate to on the forest service site. I googled the company and it's neighbor to get my info. Any advice on better navigation?

ReplyDeleteStart here: https://www.fs.usda.gov/coronado

Deletemaybe their mistake related to that 8/2020, while management expects drilling to begin in H2/2019?

ReplyDeleteYou can look at the past history of getting projects approved at this ranger station, it's about a ~2 year process for an EA. The only hope to drill later this year is to downgrade the program to a few holes and attempt a CE (Categorical Exemption from environmental review). That's what the previous operators tried to do before throwing their hands up.

DeleteTo their credit, the company has now aligned its timeline with the realities of U.S. Forest Service permitting in the Coronado National Forest. As per their May 2019 Corporate Presentation:

ReplyDelete2020

• Initial drilling campaign at Sunnyside once permits

are in place

Will follow up with a post later.